The Invisible Crash

The U.S. Dollar is a promise to pay. Gold is payment in and of itself. - Rick Rule

There is More Opportunity Today Than There Has Ever Been in Human History. - Bob Moriarty

A great burden was lifted from my shoulders the day I realized that no one owes me anything. For so long as I’d thought there were things I was entitled to, I’d been wearing myself out —physically and emotionally — trying to collect them.

No one owes me moral conduct, respect, friendship, love, courtesy, or intelligence. And once I recognized that, all my relationships became far more satisfying. I’ve focused on being with people who want to do the things I want them to do.

That understanding has served me well with friends, business associates, lovers, sales prospects, and strangers. It constantly reminds me that I can get what I want only if I can enter the other person’s world. I must try to understand how he thinks, what he believes to be important, what he wants. Only then can I appeal to someone in ways that will bring me what I want.

And only then can I tell whether I really want to be involved with someone.

No one owes me moral conduct, respect, friendship, love, courtesy, or intelligence. And once I recognized that, all my relationships became far more satisfying. I’ve focused on being with people who want to do the things I want them to do.

That understanding has served me well with friends, business associates, lovers, sales prospects, and strangers. It constantly reminds me that I can get what I want only if I can enter the other person’s world. I must try to understand how he thinks, what he believes to be important, what he wants. Only then can I appeal to someone in ways that will bring me what I want.

And only then can I tell whether I really want to be involved with someone.

___________

The U.S. 10 Year Treasury Bond is considered a staple for collateral. The 36 year bull market in this financial holding has produced sanguine sentiment changes regarding the balance sheet of U.S.A. Corp and confidence in paper assets in general. Confidence in paper holdings has not only created a sale in hard assets but real collateral (gold) and monetary metals which are entering liquidation pricing (cost of production exceeding current COMEX market value).

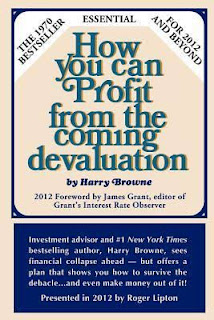

James Dines published ‘The Invisible Crash’ in 1975 with the thesis of financial asset prices becoming severely devalued when priced in real things like gold. The U.S. Dollar was officially detached from gold in August 1971 and all world currencies sold ‘found their value’ relative to real assets in the inflationary seventies. With the denominator (fiat currencies) actively devalued many stock prices didn’t collapse or crash priced in currency but were a disaster when looked at in a different metric. Few investment advisors today would imagine the Dow Jones Industrial Average went nowhere - range bound from 1K to 1,200 - from 1964 to 1982.

The Greatest Transfer of Wealth is accelerating. Prudent capital is moving beneath the surface not seen by those still plugged into the System. The exodus could accelerate like a rogue wave preparing for what is unknown and while not may be imminent but certainly to be inevitable. Right now we seem to be in the eye of a storm. Peaceful and primal emotions of greed and hubris seem dominant.

Current Western World Securitized markets have enabled a world of consumption exceeding Equity Creation never imagined at such levels. We understand this process to be ephemeral and as respecters of real history know ‘The Market is not to be Conned.’ [1]

Ludwig Von Mises teaches in his Epic ‘Human Action’ most are not fact finding creatures. Ethnocentric Ideals and Ego often cloud the mind. Purity often comes from pain and addressing our worst fears. Most use analytical basis upon the past decade rather than fundamental data. Building a contrarian investment company, learning to surf big game, coming out of jail and living overseas away from comforts of home are experiences where I learned my past in New England made me a clear outsider.

“We don’t see things as they are. We see things as we are.” - Anais Nin

Material Gain is not the prime goal of this blog nor our enterprises along the Uruguayan Coast. We see ourselves empowering teams to help build dreams.

When coming out of the furnace the primary focus of the creator was to change the mind.

Leading mentor’s - Free Education -

Philosophical Core is Essential to building a foundation.

Waves are made of energy traveling hundreds of miles until they reveal themselves on shallow reefs or sand. Watermen today have access to many new technologies to try and time the arrival of swell to capitalize on improved conditions. Like wave energy and the change in ocean conditions with seasons and storms, world economic and financial markets can often be predicted in the long run should the individual conduct an accurate fundamental analysis.

Buzzy’s comments regarding changing the perception of measuring by the correct denominator.

“There’s a great deal more to becoming rich than buying the right investments and hoping for the best. The most important element in your strategy to win the battle for investment survival is your own psychology.” - Doug Casey

Comments

Post a Comment